What is Working Capital?

Find out what it means for your business to have working capital, and learn how to calculate it. Includes frequently asked questions.

Updated on March 31st, 2020

The SMB Guide is reader-supported. When you buy through links on our site, we may earn an affiliate commission. Learn more

Working capital is the amount of money that your business has access to after all current liabilities have been paid off. In other words, it is the difference between your current assets and your current liabilities. A healthy company should have positive working capital.

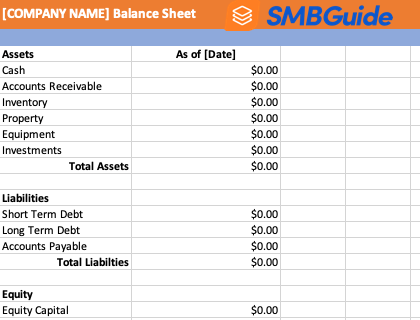

Balance Sheet Template - Free Download

Use our Excel balance sheet template to list all of your assets and liabilities and find out how much working capital you have.

How to Calculate Working Capital:

Working capital is calculated using the formula:

Current assets - Current liabilities = Working capital

If we wanted to find the working capital of ABC Inc. for example, we would take the following steps:

1. Find the total of current assets on the company's balance sheet.

For the sake of this example, we will say that ABC Inc. has current assets totalling $150,000.

2. Find the total liabilities for the same period.

On the same balance sheet, you should be able to add up all liabilities for the same time period. Let's say that ABC Inc. has $100,000 in liabilities.

3. Subtract the liabilities from the assets.

$150,000 - $100,000 = $50,000. Therefore, ABC Inc. has $50,000 in working capital.

Types of Working Capital:

1. Gross Working Capital.

The total current assets on a company's balance sheet that can be liquidated if necessary.

2. Net Working Capital.

The difference between current assets and current liabilities.

3. Fixed Working Capital.

Working capital that is associated with fixed assets (property, equipment, etc.) needed to continue business operations.

4. Variable Working Capital.

The difference between fixed working capital and net working capital. Variable working capital may increase or decrease on a seasonable basis as new assets may be required.

FAQs:

How do you calculate working capital?

To calculate working capital, you should subtract all current liabilities from all current assets.

What is the concept of working capital?

The concept of working capital is to more accurately reflect the liquidity of a business and how much money it has access to. A business may have $10,000 in the bank, but that does not accurately reflect its financial state if the business is also $20,000 in debt.

What is working capital in simple terms?

In simple terms, working capital is the difference between a company's assets and its liabilities.

What are the four main components of working capital?

- Cash.

- Accounts receivable.

- Inventory.

- Accounts payable.

What is good working capital?

It depends on the size of your company, but good working capital is always positive. If you have negative working capital, it means that your liabilities outweigh your assets.

What is an example of working capital?

A company with $50,000 in current assets and $30,000 in current liabilities has $20,000 in working capital.

What are the types of working capital?

- Net working capital.

- Gross working capital.

- Fixed working capital.

- Temporary working capital.

Why is working capital needed?

You need working capital to keep up with the day-to-day operations of your business. Working capital can be used to purchase supplies, pay bills, secure more inventory, etc.

What is the difference between working capital and net working capital?

Working capital is a term that is sometimes used to refer to a company's current assets, while net working capital refers specifically to the difference between current assets and current liabilities.

Is cash included in working capital?

Cash is usually included in working capital calculations as it represents purchasing power.

How do you calculate working capital in Excel?

To calculate working capital in Excel, find the difference between your current assets and current liabilities on your balance sheet. We've put together a free downloadable balance sheet template to do this for you.