How to Get a Business Credit Card

Learn How to Get a Business Credit Card. Includes a step-by-step guide, checklist, and FAQs.

Updated on September 19th, 2023

The SMB Guide is reader-supported. When you buy through links on our site, we may earn an affiliate commission. Learn more

A business credit card offers small business owners a variety of rewards and benefits. Whether you're a freelancer or start-up owner, a business credit card can help streamline finances and is a popular alternative financing option to business loans.

The rate on business credit cards is often lower than the national average. In April 2018, the APR of business cards offered online was 2.5% lower than the national average for general purpose cards, averaging around 14%.

For funding purposes, around 30% of small business owners were more likely to obtain business credit cards for capital. Startup businesses came in around 44%, proving that business credit cards are popular with entrepreneurs looking for access to capital.

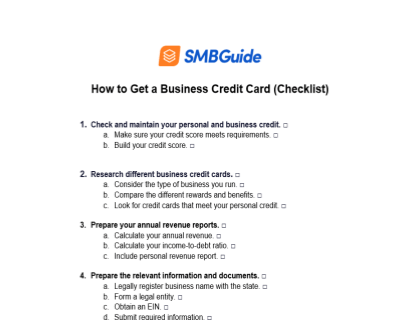

How to Get a Business Credit Card Checklist

Stay on task and download our detailed checklist on How to Get a Business Credit Card.

What You Need To Apply:

1. Your state-registered business name.

You will be required to submit your business's state-registered legal name. This is the name you will conduct business under and it will appear on your business credit card if you are approved. If you decide to conduct business as a sole proprietorship, freelancer, or general partnership, you can submit your own legal name.

2. Your business contact information.

This should include your business address, phone number, and other means of contact. Business owners that operate from home can use their home address and phone number.

3. Your business' legal structure.

You will be asked about the type of business you're operating as, such as a corporation, partnership, non-profit, LLC, or sole proprietorship. As of May 2018, new laws require that personal information should also be provided for beneficial owners who own 25 percent or more of a business.

4. Your industry type.

Banks will want to know which industry your business falls under. For example, agriculture, finance, beauty, medicine, etc. You will have the option to select which industry suits your business.

5. Your business history and number of employees.

You will be asked how long you've been in business and how many employees you currently have. If you're starting a new business, you can choose the lowest option provided to you. In addition, sole proprietors or freelancers can list one employee.

6. Your federal tax ID.

Also known as an Employer Identification Number (EIN), this refers to the nine-digit number the IRS provides to registered businesses. To obtain an EIN, complete the online application on the IRS website. There is no application fee required. Sole Proprietors that don't have an EIN can still apply for a credit card using their Social Security number.

7. Your annual business income.

Banks and credit card companies will want to know how much income your business brings in every year. This information is required so that card issuers can confirm you are able to pay them back and to help calculate your debt-to-income ratio.

It's important to note that your business doesn't have to be your main source of income in order to be approved for a business credit card. If you are a freelancer or independent contractor, you can submit your personal revenue.

Calculating Annual Income:

Add your total income together, which includes your full-time job and part-time job earnings, and all sources of personal and business income.

Calculating Income-to-Debt Ratio:

Divide your total monthly debt payments, such as business loans, mortgages, credit card bills, etc, with your gross monthly income.

8. Your personal information.

You will have to submit your personal contact information, including your legal name, Social Security number, address, and more. In addition, you will need to describe your role in the business. The credit card company or bank will use this information to check out your personal credit score.

Benefits Of A Business Credit Card:

- Ensures business and personal finances are separate.

- Earn business rewards.

- Streamlines finances.

- Takes care of urgent and unexpected expenses.

How to Get a Business Credit Card:

1. Check your personal and business credit.

Before you start the application process, be sure to check and maintain a good credit score for both your personal and business finances. Banks may consider factors that affect both your personal and business finances, such as business profits and expenses, as well as your personal income.

If you have no or low credit scores, you can still apply for a business credit card but your options may be limited. However, there are steps you can take to improve your credit score, such as paying all bills on time, staying below your credit limit, and bringing your balance down to 30%.

Alternatively, you could apply for a secured credit card, which was designed for individuals with low credit scores. With this card, users are able to improve their credit score with responsible usage and graduate to an unsecured credit card.

2. Research which business credit card suits your business needs.

Consider the type of business you operate and research how you can improve your rewards based on your business' expense requirements. To help make the decision, compare each business credit card provider side-by-side, and weigh the benefits and disadvantages.

You need to keep four factors in mind when comparing business credit cards:

- Annual Percentage Rate (APR).

- Fees.

- Rewards.

- Card type.

3. Prepare your annual revenue reports.

Almost all banks will request to see your financial documents, especially your annual revenue. Card issuers will want to ensure that you are able to pay back your balances. If you are starting a business, you can use your personal income as reassurance. This way, your credit card qualification will depend on your personal income reports.

4. Make sure you have all the information you need to apply.

Before you can apply for a business credit card, you will need to get all your financial reports and business information in order. To apply, you will be required to submit certain information, such as your state-registered business name, your legal business structure, Employer Identification Number (EIN), your business' contact details, and more.

Read about what you need to know before applying.

5. Apply for a small business credit card.

Once you've researched the different options and chosen the business credit card that suits your business needs, you can begin the process by applying. For faster results, check to see if you can apply online as most credit card companies now offer an online application option. However, traditional banks may require you to follow the in-person application process.

6. Be responsible.

Once you've received your business credit card, you will have access to instant finances. However, this does not mean you have the freedom to swipe whenever the opportunity arises. Ensure that you only use your credit card when necessary, always try to stick to your business budget, and make sure all repayments are done on time.

FAQs:

How do I get my first business credit card?

What is the easiest business credit card to get?

A secured credit card is the easy option when applying for a business credit card. However, this option will require a cash deposit for collateral. In addition, only a limited number of card issuers offer secured credit card options as they do not require high credit scores.

How can I get a business credit card without a social security number?

If for some reason you are unable to apply for a Social Security number, try applying for an Individual Taxpayer Identification Number (ITIN). Then use your ITIN to apply for an EIN with the IRS. Many credit card companies and banks allow you to apply with an EIN.

Can you use your EIN to get a credit card?

Yes. In fact, most banks and credit card companies require you to have an EIN. However, sole proprietors and freelancers are able to apply using their Social Security number.

Can I get a business credit card with bad credit?

Yes. While your options will be limited, business owners with no or low credit can still apply for a business credit card. For example, Capital One offers credit cards to individuals with low credit scores. However, this will depend on your personal credit score. Alternatively, you can try a secured credit card, which doesn't require high credit scores.

Does applying for a business credit card affect personal credit?

No, simply applying for a business credit card won't affect your personal credit. However, if you are approved, your business credit card may affect your personal credit. For example, if you sign a personal guarantee, you will be held liable for the company’s debt should your business miss any payments. In addition, some card issuers can report your business activity to both consumer and commercial credit bureaus.

What is the best credit card for a small business?

- Chase Ink Business Unlimited.

- Chase Ink Business Preferred Credit Card.

- Business Gold Rewards Card from American Express.

- American Express Business Platinum Card from AMEX OPEN.

- CitiBusiness/AAdvantage Platinum Select World Mastercard.

How do I apply for a business credit card without personal credit?

You cannot apply for a business credit card without submitting your personal credit score. In fact, most card issuers will see your personal credit as a requirement.

How do business credit cards work?

Business credit cards allow business owners instant access to a revolving line of limited credit in order to purchase items and withdraw cash. Both consumer and business credit cards carry an interest fee if the balance is not repaid in full with each billing cycle.

What is the difference between a business credit card and a personal credit card?

There are four main differences between a business and personal credit card:

- Small businesses are not covered by consumer protections.

- Business credit cards can affect both business and personal credit.

- Business credit card limits are generally higher.

- There are different types of rewards on offer.

How do I get a business line of credit?

- Check and maintain a good credit score.

- Compare your options.

- Make sure your documents are in order.

- Apply online.

Can you get a business credit card without a business?

Yes. Even if you don't have a legal entity, you can still apply for a business credit card.

Can a business get a secured credit card?

Yes. Business owners can apply for a secured credit card while improving or building their credit score. Over time they will be able to qualify for an unsecured credit card.

Do I need to sign a personal guarantee?

Typically, yes. Almost all business credit card issuers require a personal guarantee stating that the company/bank holds you personally, financially responsible if your business fails to repay credit card balances.

Which types of businesses qualify for business credit cards?

There are many businesses that are eligible for a business credit card. Whether you're starting a new business or already own a business, you are able to qualify for a small business credit card. In addition, if you do not have a legal business structure in place, you can still qualify for a business credit card if you’re obtaining an income from conducting an act of service, working as an independent contractor, or selling goods.

What information do I need to apply for a business credit card?

- Name and surname.

- Date of birth.

- Business name.

- Business address.

- Type of business.

- Business contact number.

- Employer Identification Number (EIN).

- Annual business or personal revenue.

- Years in business.

- Monthly business or personal expenses.

- Personal income.

- Social Security number.